The US is seriously underemployed.

Not blessed with the same level of programs we have (but better than say Botswana) the unemployed do not have an easy time. Hence employment levels have always been much higher than in Canada or Europe.

They usually run an unemployment rate of 4-5%. We are now at nearly 10%!

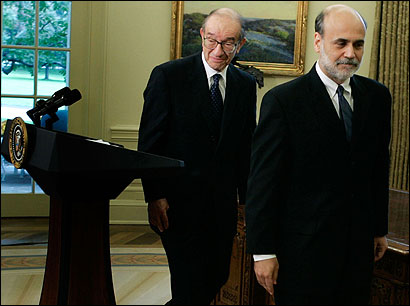

Why? Thanks to these two gentlemen.

Greenspan in pushing financial deregulation:

"The use of a growing array of derivatives and the related application of more-sophisticated approaches to measuring and managing risk are key factors underpinning the greater resilience of our largest financial institutions .... Derivatives have permitted the unbundling of financial risks." -- May 2005

Derivatives caused the biggest financial collapse and bail-out in US history-AIG.

On the threat of a housing blow-up:

"Even though some down payments are borrowed, it would take a large, and historically most unusual, fall in home prices to wipe out a significant part of home equity. Many of those who purchased their residence more than a year ago have equity buffers in their homes adequate to withstand any price decline other than a very deep one." -- October 2004

One year of ownership gave him comfort in the equity of someone who BORROWED their down-payment.

Improvements in lending practices driven by information technology have enabled lenders to reach out to households with previously unrecognized borrowing capacities." -- October 2004

Unrecognized Borrowing Capacity- huh! You mean folks who cannot and should be buying a house.

In Feb 2004 he told borrowers to borrow short and variable to save 'tens of thousands of dollars in interest payments' and then raised rates 16 X- in effect killing anyone who had followed his advice.

"I believe that the general growth in large [financial] institutions have occurred in the context of an underlying structure of markets in which many of the larger risks are dramatically -- I should say, fully -- hedged." -- 2000

Within 7 short years. Three of the biggest had gone bankrupt- AIG, Lehman and Bear Stern. Citi, Merrill and many others were saved by tax-payer money.

As for Bernanke, listen to this and no more needs to be said

I was too charitable in calling them gentlemen. Fools would have been better. A perfect example of the 'emperor-has-no-clothes' syndrome. Elevate an imbecile to lofty heights and the damage they can do is extra-ordinary.

Tomorrow the US releases it's latest unemployment numbers.

No comments:

Post a Comment